If you’re applying for a financial product such as a credit card or in the market browsing your first dream home, you may have heard the terms CTOS and CTOS Score being uttered and requested for, more so when you apply for loans.

Like most first-time loan applicants and home buyers, it can be challenging to understand what it is all about and how it immensely affects your loan application approval.

Well, worry not—here’s all you need to know about CTOS and its importance for your loan application.

What is CTOS?

CTOS or CTOS Data Systems Sdn Bhd is a privately-owned credit reporting agency in Malaysia regulated by the Registrar of Credit Reporting Agencies, Ministry of Finance, under the purview of the Credit Reporting Agencies Act 2010.

It functions to maintain a record of historical information about a person’s credit experience to assess individuals or business companies’ creditworthiness and repayment capabilities.

Accordingly, the MyCTOS Basic Report and MyCTOS Score Report contains information generated from various public sources such as:

- National Registration Department

- Registrar of Societies

- Malaysia Insolvency Department

- Companies Commission Malaysia

- Publications of legal proceedings, notices in newspapers and government gazettes

The MyCTOS Score Report provides an easy and efficient checking process. It will be used as a reference by credit grantors and lenders to assess individuals’ or businesses’ financial health and creditworthiness.

CTOS is often mentioned alongside CCRIS, and some of us may think they are the same, but they are not.

The following tabulates the differences between CTOS and CCRIS:

| Criteria | CTOS | CCRIS |

| What it is | CTOS Data Systems Sdn Bhd | Central Credit Reference Information System |

| Description | CTOS maintains a record of historical information about a person’s credit experience to assess individuals’ or business companies’ creditworthiness and repayment capabilities. | A system created by Bank Negara Malaysia (BNM) that compiles credit information about a borrower or potential borrowers into standardised credit reports. |

| Governing authority | Privately-owned | Credit Bureau Bank Negara Malaysia |

| Content of report | -Identity verification -Directorship and business interests -Banking payment records -Legal actions against -Trade referees and subject comments | -Outstanding loans -Indication of joint loans or loans in partnership -Indication of Special Attention Accounts (usually Non-Performing Loans or any account under the close supervision of financial authorities) |

| Source of information | -National Registration Department -Registrar of Societies -Malaysia Insolvency Department -Companies Commission Malaysia -Publications of legal proceedings, notices in newspapers and government gazettes | All banks and financial institutions |

| Availability of report | -Free (MyCTOS Basic Report) -RM24.85 (MyCTOS Score Report) | Free |

| Access method | Available online | -Visit Bank Negara or its branches -A request via email -CCRIS online |

| Span of credit history archived | Indefinitely | 12 months |

Now that you understand the difference between the two, it is time to get to know the real deal of what this article is all about: CTOS Score and why it is important for your loan application.

What is a CTOS Score?

We often ask, “What’s your CTOS?” which is actually a shorthanded way of asking about the score on your MyCTOS Score Report.

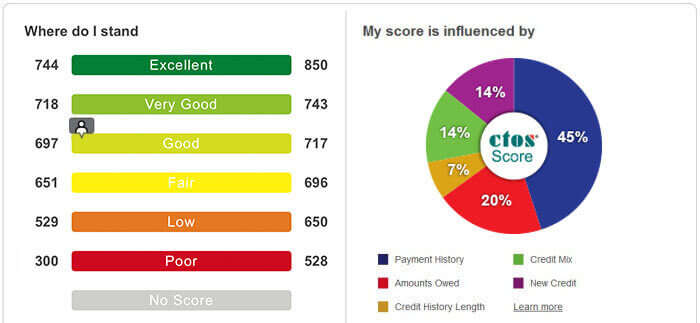

CTOS Score is a three-digit number ranging from 300 to 850, calculated by assessing your established credit history. You may think of it as acing your examination; the higher the score, the better.

Source: CTOS

CTOS adopts the globally-recognised FICO score, which is an internationally accepted process for checking credit scores. Hence, you can rest assured that your CTOS Score is fair and reliable.

Moreover, it calculates and generates your score based on the following percentage of criteria:

- Payment history (45%)

- Outstanding amount owed (20%)

- Credit mix (14%)

- New credit (14%)

- Credit history length (7%)

While your MyCTOS Score Report indicates your score and displays your credit history, it does not provide any judgements, opinions or recommendations that influence your financial product or loan application. Also, it is essential to note that your CTOS Score itself is not your final credit score.

So, you probably wonder why it isn’t so and how your CTOS Score will impact your creditworthiness.

Here’s how:

1. Used by banks to decide

When you apply for a financial product such as a credit card or a housing loan for your first home, the bank will go through a credit approval process to look into your credit history.

Then, the bank will look at your credit reports (CCRIS and CTOS) alongside your income statements and use them as references to decide whether to approve or reject your applications.

The bank will solely determine your final credit score when assessing your creditworthiness based on risk appetite, business policies and strategies and other relevant factors.

If your credit reports, particularly your CTOS Score, is favourable, the bank will usually have no qualms to approve your application.

That said, your score contributes a major part to the approval of your application.

2. Displays your credit history pattern

Suppose your score and reports indicate that your credit pattern is favourable and you are in good financial standing as deemed by the bank. In that case, the bank will be more likely to approve your application or offer a higher Loan-to-Value (LTV) or Margin of Finance to you.

Simply put, if you are applying for a housing loan, you can borrow a higher percentage of the cost of your purchase.

In contrast, if your financial standing is not good or you do not even have a credit score at all, the bank may decide to reduce the LTV or increase the interest rate.

What if there are inaccuracies in my CTOS Score?

If the information provided in your MyCTOS Score report is outdated or inaccurate, you should contact CTOS at 03-27228833 or fill up the online form and email it to [email protected].

CTOS will check and verify your concerns, and once it is done, you will receive a free updated report.

How can BlueBricks help?

CTOS issue is one of many factors that lead to a rejected loan application. Moreover, having a good CTOS Score does not guarantee a successful loan application, and your application is still vulnerable to rejection.

This is where BlueBricks can help you on what you can do to improve your score and ensure a successful loan application.

Leading loan agency company in Malaysia

BlueBricks has years of experience as a loan specialist providing loan consultancy services and comprehensive loan rejected services.

If you submit a new loan application, BlueBricks offers FREE consultation and reports for CCRIS and CTOS prior to the submission. Above all, we do not charge any prepayment for the provision of said services.

Loan Rejected Services

BlueBricks is a one-stop solution provider of comprehensive loan rejected services.

If your loan application is rejected, we can help identify the underlying problems and reasons for rejection, develop a strategy, execute amendment and rearrangement, and resubmit to the bank with a higher chance of approval.

Hear first-hand from our clients on how we help them with their rejected loan applications. If you need help with your current or future loan application, find out more about our loan rejected services.

CTOS Score – FAQ

No. The company merely compiles information on your credit and legal history from various sources and provides it to subscribers (with your consent).

It produces three types of reports from which you choose – MyCTOS Basic Report, MyCTOS Score Report, and CTOS SecureID. The basic report is free, while MyCTOS Score Report and CTOS Secure ID are RM 24.85/report and RM 99/year (exclusive of Service Tax), respectively.

Your CTOS report is updated every month as CTOS Malaysia constantly gathers and updates your credit information.

Related Posts

Understanding Your CCRIS Statement: A Guide For Beginners

Income Documents Needed When Applying For Loans In Malaysia

Proof of Income in Malaysia: Everything You Need to Know