Frequent Asked Questions (FAQ)

There is no upfront processing fee, stamp duty, legal fee or anything like that. If any of our consultant is asking any payment from you upfront, please do inform our BlueBricks management. We would report him/her to the police with you, and bring justice to the victims.

It was due to there is many loan scams in the marketplace today and they scam you by asking you pay loan processing fee. Bluebricks likes to ensure you apply your loan with us with relief and serenity, thus there is no upfront fee. But we ain't no charge fee for our services. It is just you don't pay us until you have gotten your loan from bank.

Bluebricks would only get paid after bank disburse the monies to your bank account. Prior to that, you would not being asked for a single cent.

Bluebricks don't ask for prepayment for 2 reasons. Firstly, too many loan scams out there cheat you by asking for prepayment. Bluebricks decided not to take any prepayment as we want you to feel safe and relief while we working on your bank loan; Secondly, Bluebricks understand your pain as we wouldn't want any upfront fee or prepayment that would further increase your already heavy burden. Thus, Bluebricks has decided to only charge our fee after your loan disbursement.

Bluebricks gets its profit by helping clients to acquire loan from bank successfully. Bluebricks would not be paid any fee if your bank loan is not successful. Thus, Bluebricks is 100% in this together with you as we all know there is only fee collection upon the success of the bank loan.

Our personal loan consultation fee would fall between 10% to 30% of the total loan amount. For example, if you applied for a total personal loan of RM50,000 with us, the consultation fee would fall between RM5,000 to RM15,000.

On the other hand, the consultation fee for a mortgage or refinance loan ranges between 3% to 7%. If you applied for a total mortgage or refinance loan of RM300,000, the consultation fee would fall between RM9,000 to RM21,000.

Every loan applicant wish to get their loan approved and disbursed in the given shortest time. But to have the mentioned done, the applicants have to comply to a quite comprehensive facto like your financial background, loan credibility, and your timely coordination in submitting the required documents.

For personal loan, and with good furnishing of documents required by the bank standard, you would get your loan approved and disbursed in 14 days. (To know more in details, please click the below link)

Whereas for Mortgage/Refinance Loan, with good furnishing of documents that fit the bank standard, you would expecting your loan approved in 7 working days, and your loan disbursed in 3-8 months. ( (To know more in details, please click the below link)

As the Loan Scammer knows exactly the loan applicants think, so often they would use [INSTANT] cash disbursement from bank as the bait to make you fall into their trap. But you may need to know, there is no bank would do 1-2 days approval and disbursement if you're going thru the official and formal procedure of loan application. Please do not lose your head because of desperation.

The main existence of bank is to make money, and all the different banks have their own appetite of what kind of loans and applicants they favour in.

Therefore, BlueBricks wouldn't be submitting your application to all the banks. Because it looks desperate to them as all the bank system would be indicating you applying for many loan when we submit your loan to all the banks. It is risky.

Just imagine if your friend is asking you for money, but you found out later he is too asking money from all his friends and relatives. What would you be thinking?

When one bank found out you submit the application to all the banks, you already had their attention, and thus they would be extra careful with your loan application.

Thus, BlueBricks would always first understand your loan objective , subsequently check your financial background and loan eligibility from bank. Then only we would start strategising by submitting your loan application to the bank that best suit your objective and give you the best margin of finance. We ensure a foolproof process in helping you secure your loan.

Bank interest varies according to the bank's market strategy and market trend. They would all be giving different loan packages in different loan products to their applicants (and sometimes too subject to clients' profile ). We couldn't provide you with the accurate numbers each bank is offering, but you could follow the range of interest of the common loan products below

Personal Loan: 4.88% - 12%

Mortgage Loan: 3.3% - 4.6%

Business Loan: 4% - 9.9%

Updated: Dec 2020

[Please Note: Bank interest today changes base on base rate is determined by Bank Negara Malaysia (BNM). And our base rate would be directly affected by Overnight Policy Rate (OPR) which it changes depending on the current state of global economy and its objectives. To know more about Base Rate (BR) click here]

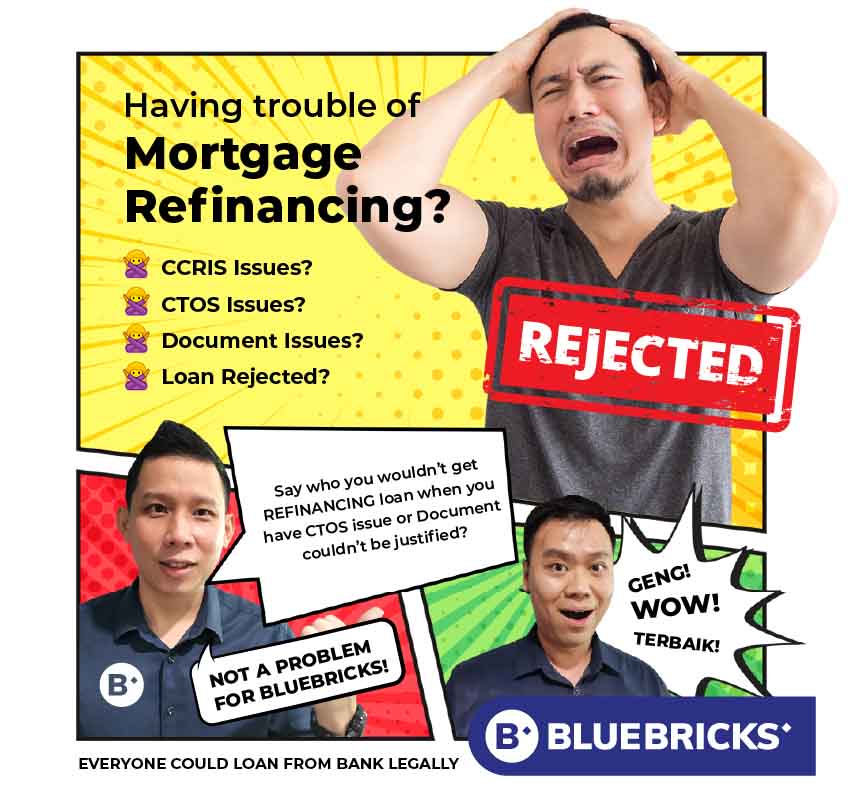

BlueBricks had positioned ourselves to specialise in Rejected Loans. But many people got their loan rejected without knowing why they are rejected. As we believe many bankers couldn't be bothered (or some bankers don't even know themselves) to disclose the real situations to the rejected applicants. What's more to explain them in details?

Majority of the bankers would only be telling your loan application failed and you wouldn't get a loan when the above mentioned issue been told to them. The reason they would tell you off and reject you verbally before access to your profile and documents is because they would choose to work on the good profile clients. Thus, they could get their sales target achieved and collect their commissions more efficiently.

Thus, clients that come to BlueBricks often are unaware of reasons why their loan was rejected, or wasn't given the solution to their problems even when they knew it.

If you are experiencing the above mentioned problems, please enquire about your bank loan eligibility with us. As we know there are always these few reasons and problems to why loans were rejected.

There isn't any magic trick BlueBricks has to help you secure your loan. To us, every problem has its reason, and to solve them we must find the source of the problem and make justification. Then in no time, we would definitely regain the access to bank loans.

Lastly, please remember not to feel devastated if you're having the above mentioned problems and thought you would not get bank loans forever.

BlueBricks would be glad to be of your assistance.

Get your loan approved with Bluebricks!

Remember, it is not end of the world when you know your loan is rejected. Please don’t go to the illegal financiers or Ahlongs feeling of despair. Worst, out of desperation and believe in the loan scams.

You would then add more problems to your already difficult situation. And to solve them, you may need more time and resources.

Now, if your loan is rejected and you don’t know what to do, please fill up the forms below, and our tele-consultants would be in touch with you in 1-3 days time via Whatsapp. And would get more details of your current situation when you have time to have a tele-conversation.