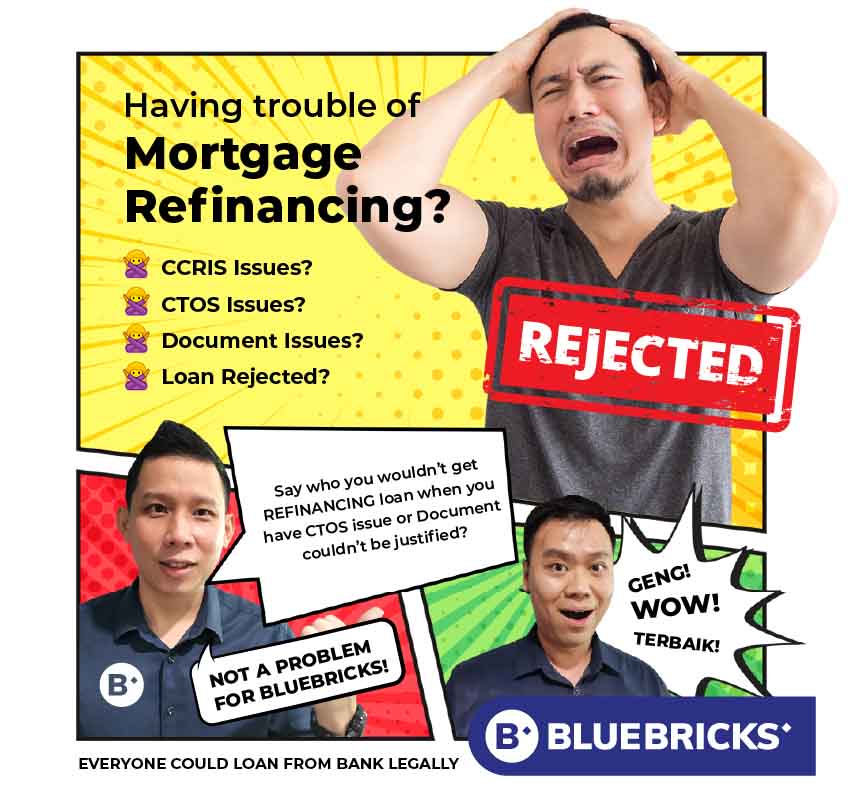

Loan Rejected Services

Loan Rejected Services is the whole process of making your loan application right after knowing your loan is rejected by handing it over to a third-party loan consultancy agency (not from banks).

The agency would help failed applicants to find out the reasons for rejection, execute adjustment and rearrangement, and submit to a bank that has a higher chance of approval and larger loan sum (if you wish) until you finally get the bank loan approved.

When all your loan applications are rejected by banks, here are the steps you should take

- Calm down, and please stop submitting to other banks.

- Check your Credit Report (CCRIS/CTOS).

- Address the issue that led to the rejection of your loan.

- Consider reapplying for the loan in 3 to 6 months (if needed).

- Rearrange your application documents.

- Calm down, and please stop submitting to other banks.

- Check your Credit Report (CCRIS/CTOS).

- Solve the problem that has your loan rejected.

- To submit your loan again in 3-6 months time (if needed).

- Rearrange your application documents.

When all your loan application is rejected by banks, below are the things you should do:

Please take note when your loan is rejected, DO NOT submit your loan immediately to another bank.

Especially when you have submitted to many banks and got rejected, please stay calm and find out all the reasons as of why your loan is rejected.

Rearrange and Resubmit

Please give yourself sometime to adjust and rearrange before submitting to bank, and it is better if you have waited for 3-6 months before submitting again. As you would have higher chance of getting it approved.

Know The DO’s and DON’Ts

Often many would think if their loan is rejected, it means they would not have chance of getting it in the future. It is not what you think it is. You would only get your loan rejected no matter how hard you try when you do not know what do the bank likes and don’ts. And the likes and donts of these bank vary from one another.

How Do You Know If You Need Loan Rejected Services?

You wouldn’t need it when you know how to secure/obtain the bank loans that you need. The fact is many thought that they knew, still eventually got their loan rejected.

For example, you could always go to the pharmacy to ask for the medicine for cold, flu or fever – if you know those are the sickness. But what if after eating those medicine you still feel uneasy? Would you continue the process go to the pharmacy, buy and eat them wishing to cure yourself?

There are two kinds of people that come to Bluebricks.

The One in Despair

The first one would be the type of clients in despair, as they got their loan rejected by banks so many times. And they somehow find out about these services that we have and hoping we would help them.

The One Understand Time Cost

The second kind of people would be the ones that understand Time Cost. They know their time is so much more expensive than the money could pay. And they know when their loan is rejected, it would make them wait another 3-6 months before they could submit again. And the cost of the time delay is often far more expensive than the money cost.

But what if we tell you Bluebricks don't collect any upfront fee for such services?

In fact, we don’t collect any fee until we help you to secure the loan you need; how does that sound?

Loan Rejected Services

How Can Bluebricks Solve Your Loan Rejected Issues?

Step 1: Consult

We would first understand the objective of your loan and what is the loan amount required.

Step 2: Find Out Why

Find out all the reasons as of why your loan is rejected.

Step 3: Solution

To tailor make the best loan solution that is for you.

Step 4: Understand

Make you understand the whole loan processes and procedures before handing over to Bluebricks to execute for you.

Step 5: Apply

To help you apply your loan with the bank that likes you (gives you good credit rating and approve higher loan sum).

Step 6: Process and Approval

Walk you through the whole process after approval that includes signing of your bank agreements and eventually get the loan disbursed (cash in hand yeay!).

Get your loan approved with Bluebricks!

Remember, it is not end of the world when you know your loan is rejected. Please don’t go to the illegal financiers or Ahlongs feeling of despair. Worst, out of desperation and believe in the loan scams.

You would then add more problems to your already difficult situation. And to solve them, you may need more time and resources.

Now, if your loan is rejected and you don’t know what to do, please fill up the forms below, and our tele-consultants would be in touch with you in 1-3 days time via Whatsapp. And would get more details of your current situation when you have time to have a tele-conversation.

Our Success Stories

Who is Eligible for Loan Rejected Services?

You have properties that you have bought more than 5 years or better 10 years more would be very advantageous for our loan rejected rescue program.

Your company has been established for more than 3 years.

You have enough substantial cash but have no idea to makes your financial profile looks cleaner.

You have a property that is belongs to your loved ones i.e. your parents, your spouse, siblings, or even friends that could be refinanced under your name.

We believe many have heard how Rich knows exactly how to leverage thru other people’s money (OPM), and often this OPM is reached thru a channel called Banking Facility. If one understands the essence of using OPM, they would understand how the rich become richer. And who needs it? Everyone. You may don’t want to be super-rich, but at least more financially independent to chase whatever dreams that you want to achieve. Remember money is not everything, but it is the fuel for you to survive and to do what you love.

Anyone that has a pre-requisite that we could lend our hands to them immediately.